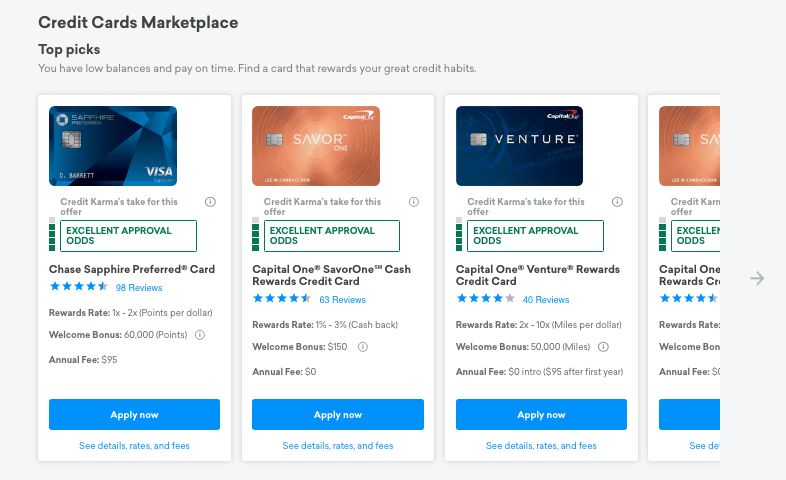

lending club approval odds

Lending Club approval. Loans are graded from A to E with A being the.

/Upgrade-6259053d518342469a569414d57a583d.jpg)

Upgrade Personal Loans Review 2022

With the ability to choose a loan amount of up to 40000 LendingClub offers fixed rates and a monthly repayment plan to fit within your budget.

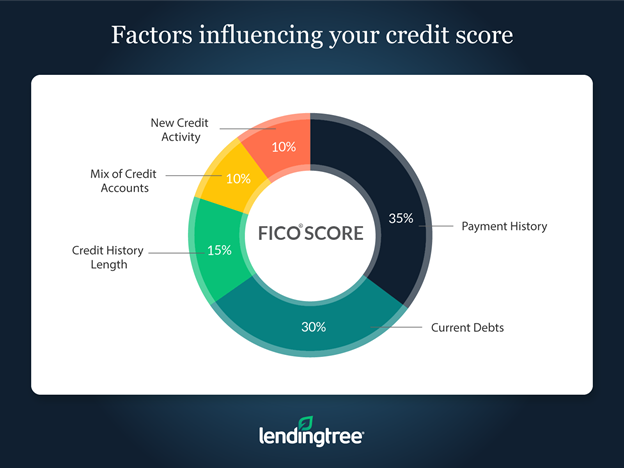

. If youre struggling to get approved for a personal loan it may be due to a variety of factors. The loan amount you may be approved for depends upon your individual credit profile and the information you provide during the. An applicants LendingClub approval odds are highest when they have a credit score of at least 660 at least.

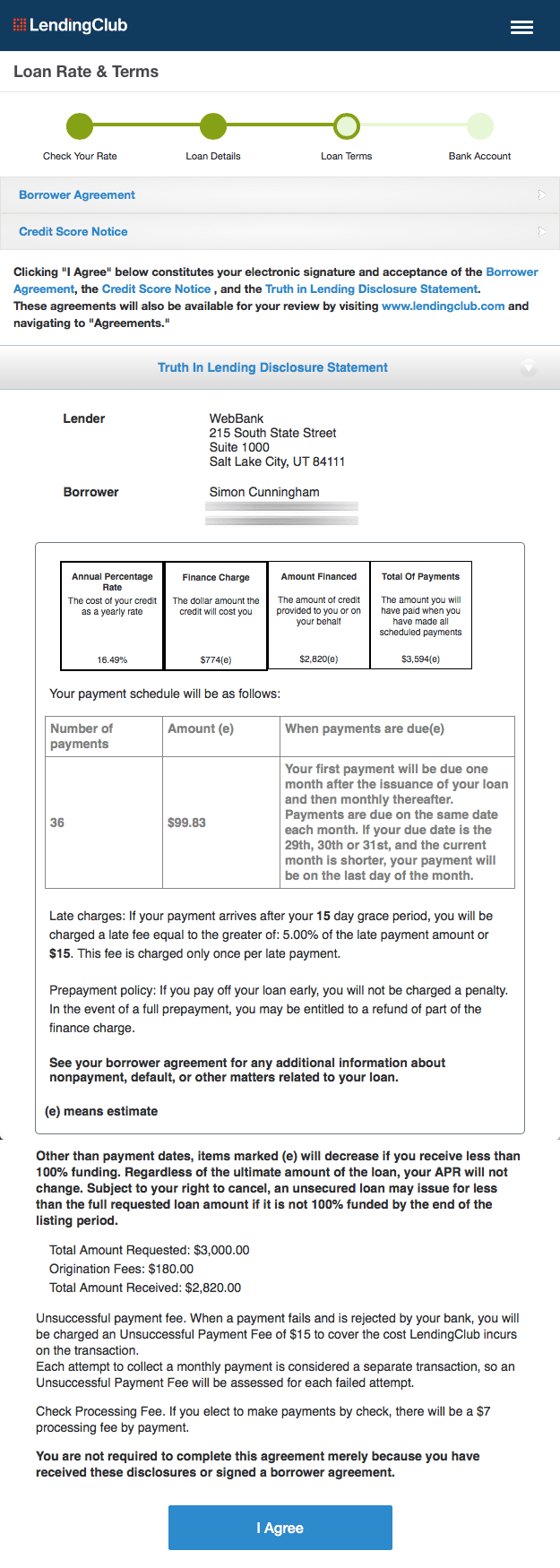

Unless otherwise specified all loans and deposit products are provided by LendingClub Bank NA Member FDIC Equal Housing Lender LendingClub Bank a wholly-owned subsidiary. The APR ranges from 1068 to 3589. For example you could receive a loan of 6000 with an interest rate of 956 and a 500 origination fee of 300 for an APR of 1311.

Some requirements include being at least. Approval and funding time. Prospers timeline from loan approval to funding typically takes five to eight days potentially a few days longer.

Some amounts and term lengths may be unavailable in certain states. Loan approval and the time it takes to issue a credit decision are. Trusted Across the Nation OpenRoad is a trusted member of the American Financial Services Association A accredited by the BBB an Inc.

Loan amounts range from 1000 to 40000 and loan term lengths are 36 months or 60 months. Applied for a Personal Loan to pay off credit card debt with Lending Club and was approved for all 40000 at 749. Adam McCann Financial Writer.

Get up to 40000 in just a few clicks. Your initial application consists of a soft credit pull which allows us to provide you with a fast pre-approval decision that wont impact your credit score. Applied on 326 and.

Your LendingClub approval odds are good if you have a low debt-to-income ratio and meet LendingClubs requirements to get a loan. Lending Club interest rates vary between 646 and 2727 depending on the loan grade. Between April 2022 and June 2022 Personal Loans issued by LendingClub Bank were approved within 2 hours on average.

Our personal loans range from 2000 to 36500. Lending Club Rates and Fees. It requires a minimum credit history of two years.

If you choose to take the offer we may ask you for documentation to verify your. At LendingClub you apply online and find out instantly whether youre pre-approved and what your offer is. Here are six ways you can tackle your next personal loan application and boost your.

APR ranges from 704.

Lendingclub Review For 2022 Peer To Peer Personal Loans

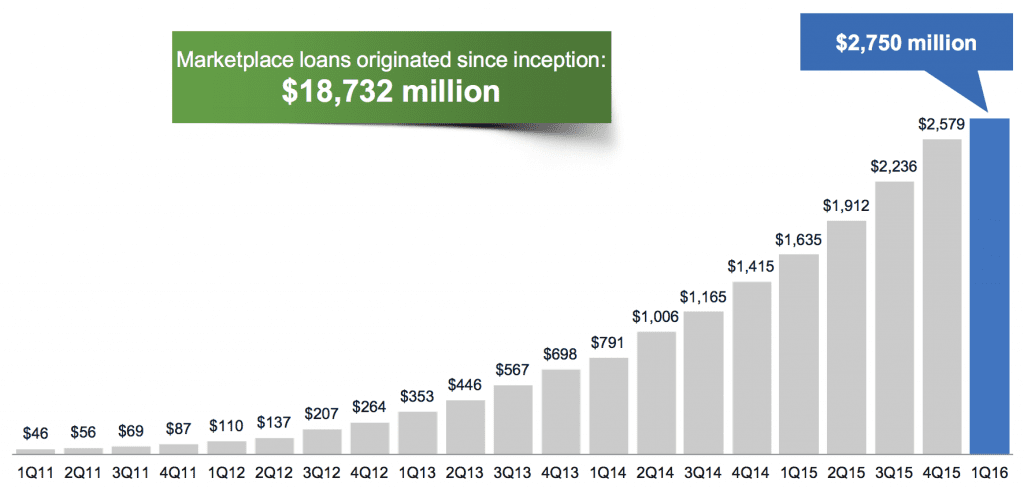

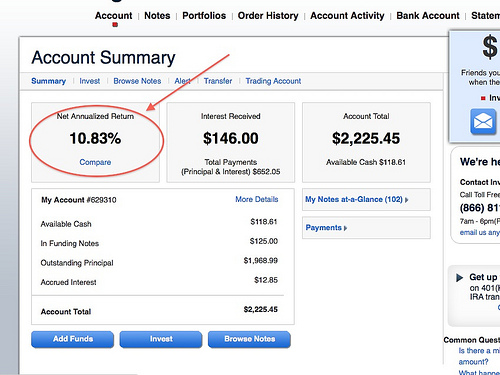

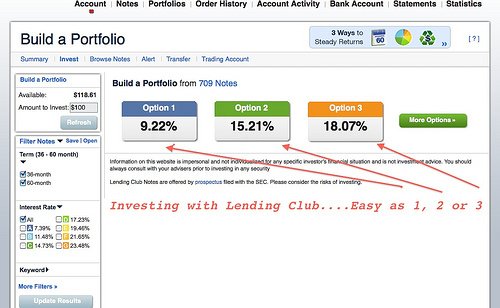

Lending Club Reviews For Investors And Borrowers Is It Right For You

Lending Club Review Can It Refinance You In 2022

How Accurate Are Credit Karma S Approval Odds Lendedu

Lendingclub Personal Loan Review 2022

Upstart Personal Loans Review 2022

Boost Your Chances Of Getting Your Personal Loan Approved Nerdwallet

Lending Club Review Can It Refinance You In 2022

5 Best Loans For Bad Credit Of 2022 Money

How To Apply For A Personal Loan 6 Steps Lendingclub

Best Payday Loans Online For Bad Credit With Guaranteed Approval In 2022

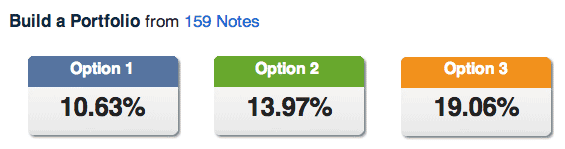

Lending Club Review For New Investors Lend Academy

How Accurate Are Credit Karma S Approval Odds Lendedu

Lendingclub Personal Loans 2022 Review Nerdwallet

Lending Club Reviews For Investors And Borrowers Is It Right For You

7 Reasons Why Your Personal Loan Was Declined And How To Fix It

Lending Club Review For Borrowers 2019 Is This Company Legit

Lending Club Peer To Peer Lending 101 For Curious Investors

First Lendingclub Will Lose Money Then It Will Become A Bank The Rest Is A Shot In The Dark Nyse Lc Seeking Alpha